CIRCUSOL: Solar power business models towards a circular economy in Europe (PRESS RELEASE)

CIRCUSOL: Solar power business models towards a circular economy in…

The 2nd life battery market is a very young market (~150-160M USD) emerging from the increasing usage of lithium-ion batteries in traction groups in electric vehicles and heavy mobility applications (such as trucks or buses). As their main defining factor, 2nd life batteries are coming from end-of-life lithium-ion traction batteries meaning that they are coming degraded in terms of usable capacity and immediate power but still are able to function as well as 1st life batteries. They are also coming on average 6 to 8 years (with some earlier than that due to accidents (with accidents increasing with the number of available vehicles or recall campaigns) after their first introduction to the market.

Taking into consideration how fast battery architecture, internal design and chemistry are changing, they can be a bit behind in terms of characteristics in comparison to batteries of the same chemistry. This gap is not as great since evolutions in batteries are mainly small density evolution (2%/3% yearly) or production cost reductions with no impact on energy. It is actually not a noticeable problem as they are not supposed to serve the same function as in their first life but rather be placed in less demanding electrical storage (base stations, energy storage from renewable energies, grid support, isolated sites, etc.)

In terms of actual market sizing, China is the most prominent market, followed by Europe and the USA, which is comparable to the recycling market where 85% of the batteries go to China and South Korea.

First of all, there will be a change in the mentality of automotive and battery makers. They will want as much control over their batteries as they can while still retaining as much value as possible, and in that, they need to find a balance between the cost of controlling everything and the loss in value by freeing the market. Circular models are being developed and have been tested for some years now, the likes of which the most-known leasing model, advocated by French carmaker Renault with their Zoé electric-car. This type of model is also much more relevant in a business-to-business environment for buses, taxis or delivery vehicles and considering their development should be as high or higher than for the individual vehicles, this should be a boon for 2nd life batteries as car and battery manufacturers would be keen to assess the quality of their products to give them as much value as possible in the 2nd life without having to invest as much in R&D. This state-of-mind is also dictated by the fact that the evolution of battery chemistry tends towards more and more Nickel-Manganese-Cobalt (NMC) with a lower amount of Cobalt, thus diminishing the recycling output value which in turn increases the recycling fee. As NMC is the chemistry of choice for traction batteries compared with Lithium Manganese-Oxide (LMO) and Lithium-Iron-Phosphate (LFP) we can only assume that further reduction in value for NMC is to be expected (and already announced for example by BASF).

Secondly, there will be a technical development going alongside the surge in availability as both solutions to assess batteries if they are not under any direct control from their Original Equipment Manufacturer (OEM) and to remanufacture them will benefit from economies of scale. The first aspect – assess batteries through the end of their first life – is for now requiring either long years of R&D to develop a tool capable of analyzing an unknown battery module or the collaboration with the carmaker (rarely seen in current events apart from their own initiative, linked with the above paragraph). In the future we can expect that either investment will be done by remanufacturing firms to deal with the specific influx of batteries they could obtain through their contracts or sufficient standardization efforts have been done and a simpler, more common model of assessment can be used. This assessment is also concurrent with the fact that 2nd life batteries have to abide by the same regulations as the first-life batteries, which are very stringent.

Finally, and lightly brushed upon in the previous paragraph will be the willingness to push environmentally- friendly agendas from public policies. They can make or break the EV surge (as we saw when subsidies in China stopped pouring out, and the market reacted accordingly by dropping). They will be a powerful tool as we already said for the technical side of things, by forcing certain cooperation by standardization but their main point will be influencing national policies to free themselves from eking out of the coal and oil boosted industry. Incentivization and ambitious national goals will spur competition among equally-minded countries and will allow newer and greener technologies to replace the existing ones.

This young market is driven by new ideas but controlled – for now – by old businesses.

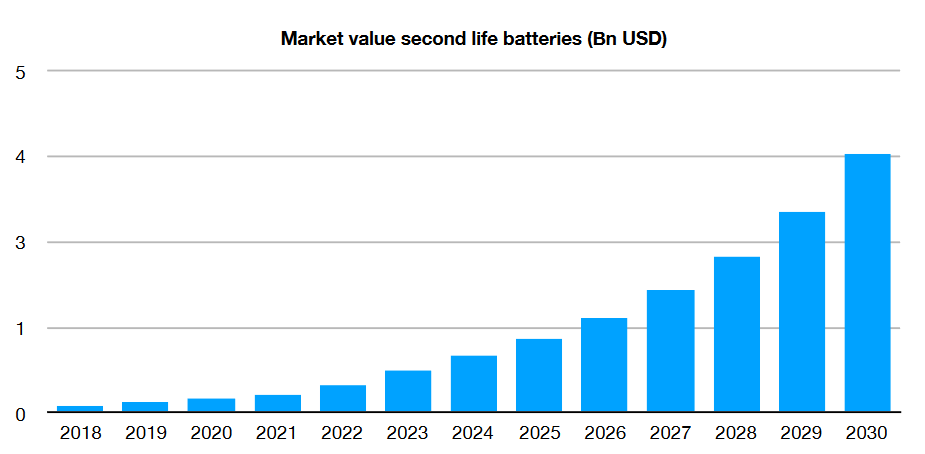

However, there are clear markers that show that the promise of a 4bn USD market by 2030 (fig. 1) is not an unrealistic one, provided that some of the obstacles along the way get cleared with a good dose of human ingenuity and maybe a healthy portion of the environment-oriented public mind.

Figure 1 - Market value of second-life batteries in billion USD (source)

Nicolas Perdriaux is a Projects Economic Assistant who holds a Master in Supply Chain Management and has been employed at SNAM since 2017. His main activities include financial controlling and administrative support for the European and national projects in which SNAM is involved. He also works in the accounting department on controlling activities. His transversal activities allow him to be in contact with every other department to keep in touch with the latest developments in Operations and R&D.

SNAM is a European player in the collection and recycling of batteries, born from the metallurgical industry in 1981. SNAM is the ideal partner for large international companies for the treatment of their waste containing heavy metals. The company provides the best available technologies that enable it to be one of the few companies in the world to master metal recovery techniques (Cd, Li, Ni...).

SNAM’s main roles in the project are to supply remanufactured batteries electric vehicles, to lead cost and application analysis for second-life batteries, and to support CEA in developing labelling/certification protocol.

CIRCUSOL: Solar power business models towards a circular economy in…